FXSpotStream Celebrates 9 Years of Service

A Letter From The CEO

Dear Valued Clients, LPs and Vendor Partners,

Nine years ago, with the support of our founding banks, we set out to provide a more efficient, less expensive, more transparent way to allow our original six liquidity providing banks to interact directly with their clients and vice versa. One API in NY/LDN/TY, no fees for clients and a fixed fee for our LPs.

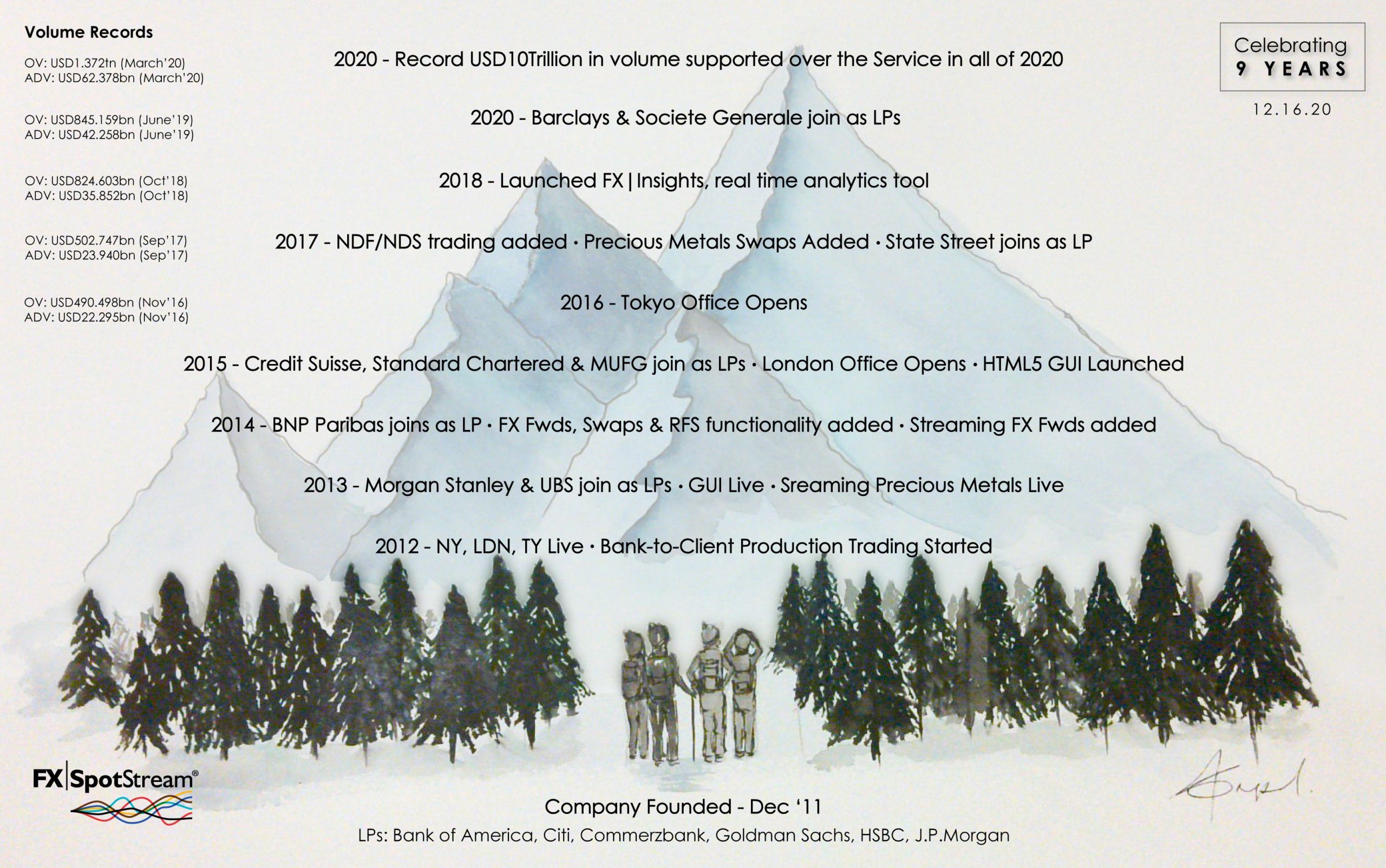

Fast forward to today and we are one of the fastest growing FX channels in the industry. Since our formation exactly 9 years ago we have added 9 more LPs, taking our total to 15, including: Bank of America, Barclays, BNP Paribas, Citi, Commerzbank, Credit Suisse, Goldman Sachs, HSBC, J.P. Morgan, Morgan Stanley, MUFG, Societe Generale, Standard Chartered, State Street and UBS. We have expanded the offering from a spot FX API to now include support for FX Spot, Swaps, Forwards, NDF/NDS and Precious Metals Spot and Swaps. We have added a GUI, a robust analytics tool – FX|Insights – and many order types and additional functionality. We have grown our client base around the world and now have staff in the US, the UK and Japan. And this year we broke another record crossing the USD10 Trillion mark in terms of volume supported on the Service – the most volume ever supported in any one year.

Despite our growth, I still view ourselves as a “start-up” and that’s how we run our business every day. We are about identifying an issue and finding solutions. Our team is about getting things done and moving the ball forward. And it’s because we have a great team that is aligned with the core principles of our company that we continue to grow every year.

In addition to working hard every day, I have always been keen to emphasize to the team the importance of customer support – ensuring that our clients, banks and vendor partners always hear from us when there’s an issue and that we address issues when they happen. We are a technology company and we will have issues from time to time. But the key is that we acknowledge when there’s an issue and we fix it. When a client has a need we address it. We have grown on all fronts in 9 years, but I am extremely proud of the fact that we have not forgotten our roots and we have maintained the top-level support that we are recognized for.

To those that have joined us along the way, we say thank you. Your loyalty and support have been instrumental in getting us to this point and will continue to drive us forward in the future. For those that we are yet to meet, we look forward to the opportunity to serve you and your business. Feel free to drop us a line at sales@fxspotstream.com if we can help.

Looking forward, we are very excited to have a large functionality announcement coming in Q1 next year that will see us continue to expand our offering to the FX market. Stay tuned!

Last, we take this opportunity to reflect on how fortunate we are to be able to continue doing what we do. It is a testament to our team that despite incredibly challenging times our business has continued to grow this year and we’ve had no interruptions to the Service. The FX market has seen its share of turbulence over the years and always comes out stronger. We are confident that the market and the many good people in the market will turn the corner in 2021. We won’t forget 2020, but we look forward to a return to a more normal world next year.

Best to all during the holiday season.

Warm regards,

![]()

Alan F. Schwarz,

Co-Founder, CEO FXSpotStream and the FXSpotStream Team

More Posts from FXSpotStream®

Featuring: Dan MacGregor (State Street), Ajay Kataria (Barclays), Loic Bourgeois Ducournau (Societe Generale) and Alan Schwarz (FXSpotStream) Understanding your market impact is a huge factor in any trade. Algos can be configured to your desired execution styles (passive, neutral or aggressive) and altered during execution. In our final episode we will discuss the WHY. When…

Featuring: Mark Meredith (Citi), Nickolas Congdon (Commerzbank), Evangelos Maniatopoulos (Credit Suisse) and Raju Dantuluri (FXSpotStream) In episode 3 we take a look at algo strategies with speakers from Citi, Commerzbank and Credit Suisse. Strategies are the big differentiator when choosing an algo and although some may appear similar on the surface, by controlling the parameters…

Algo Types: Accessing Spot Contingent Forwards and NDF Algos

Featuring: Paris Pennesi (HSBC), Alexander Nowak (J.P.Morgan), Asif Razaq (BNP) and Tom San Pietro (FXSpotStream) Understanding how the LPs deal with Spot contingent Forwards where clients can set a forward date on order entry and the Algo would automatically roll forward after it has executed. Popularity of NDF currencies with respect to deliverable currencies for…

FXSpotStream registered a NEW RECORD ADV HIGH in March ’22 surpassing the ADV record set last month. March’s ADV of USD70.115billion is an 11.06% increase over February’s ADV of USD63.135billion and completes what has been the highest volume quarter in the company’s history. In Q1 2022, FXSpotStream supported USD3.988trillion, with a Q1 ADV of USD62.313billion.…

Join FXSpotStream, Representatives from the FXSpotStream Liquidity Providing Banks and Moderator, Colin Lambert of The FullFX, as we sit down with our LPs to discuss FX Bank Algos. This 4-part series will be broadcast in LIVE sessions as we uncover different aspects of FX Bank Algos, how clients can use and benefit from the Bank…

February Volumes: All-Time ADV Record High

In February 2022, FXSpotStream registered a new high in terms of supported volume with an ADV of USD63.135bn. This represented a 19.15% increase MoM (compared to Jan ’22) and a 27.3% increase YoY (vs Feb ’21). The previous ADV high was in March 2020 as volatility around the Covid-19 pandemic reached its peak. Furthermore, February…

2021: A Year In Review

In 2021, FXSpotStream registered an ADV of USD48.397billion, an increase of 13.48% YoY vs. 2020 as we continue to gain market share. FXSpotStream reported positive YoY growth each month in 2021, with the exception of one. This growth was driven by positive YoY growth in all products, notably a 26.94% increase in Swaps ADV and…

FXSpotStream has been voted Best Margin FX ECN/Multi bank platform in the J-Money Survey for the 5th consecutive year. J-Money is a leading industry magazine for financial professionals in Japan. Founded in 1986, J-Money has published articles and editorial articles covering market trends such as foreign exchange, bonds and stocks, as well as developments in…

New Microsecond Low-Latency Architecture Announced

October 6, 2021 – JERSEY CITY, NJ – FXSpotStream (FSS) announces the deployment of a new low-latency architecture. The new architecture, which will be deployed globally, will deliver substantial improvements to the Service’s market data processing times. The project is already underway in the New York site and will involve a full overhaul of the…

The Full FX Unfiltered with FXSpotStream

Colin Lambert talks with Alan Schwarz, CEO, and Tom San Pietro, CTO, of FXSpotStream about the platform’s recent addition of algos. The three discuss the thinking behind the launch; the challenges of delivering multiple algos, from multiple providers, via an API; and the opportunity set for FXSpotStream and its clients on the buy and sell…